I’ve been self-employed for years which is why I think it’s important for me to share how to write off meals as a sole proprietorship, freelancer, or independent contractor. Prior to officially starting my consulting business, there were numerous occasions where I’d meet up with a client and grab a bite to eat while reviewing and discussing their business plans. Unfortunately, I missed out on writing off those meals since I didn’t know about them. Well, I may have heard about them but I thought they were only for legit registered businesses such as LLCs, S-corps, or partnerships. I’ll be blunt and let you know now, I was wrong.

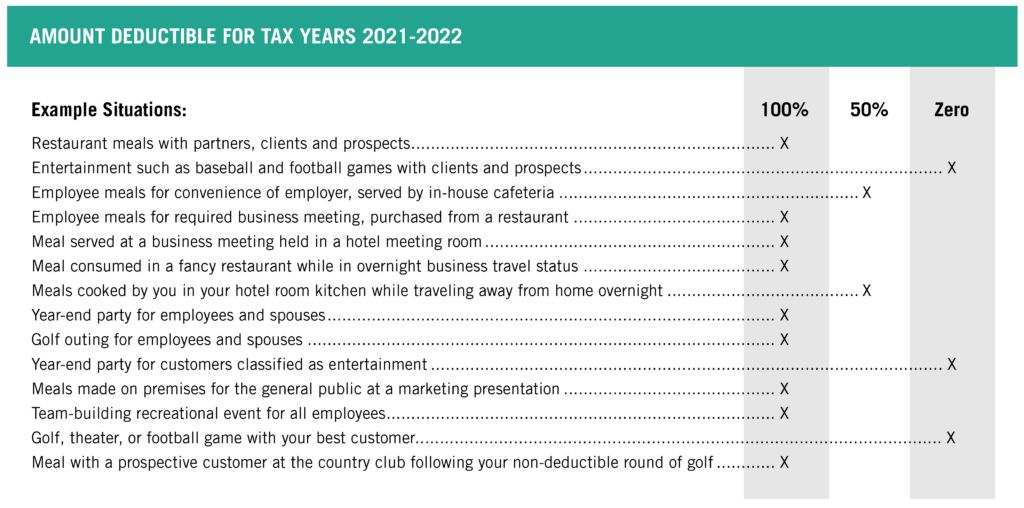

Whether you are part of the gig economy working on platforms such as Upwork or Fiverr for example, consider having a client meeting over lunch or dinner instead of zoom or just talking. By meeting in person and discussing business, is considered a business meal with a client or prospect. And as you’ll see in the video below, you can deduct these meals for 2021 and 2022! These business meals are deductible for self-employed people just as they are available for officially registered businesses because they are basically the same, just without the protection which is why so many lawyers suggest forming an LLC or S-Corp.

Of course, this isn’t legal or financial advice. But don’t be like me for 10+ years missing out on little deductibles that might add up to a large amount. These meal write-offs will help you to keep more of your hard-earned cash as you get ready to do your taxes for 2021.

Based on the info at Bench.co, let’s dive into the nitty-gritty to help explain when your self-employed business expenses are 100% or 50% deductible in 2021 and 2022.