Understanding the Earned Income Tax Credit and Other Ways to Keep More of Your Money

The Earned Income Tax Credit is good stuff. After all, taxes are a necessary evil we must deal with. Every year, we scramble to gather our receipts and financial statements to make sure we get the best possible refund or pay the least amount of taxes owed. For working-class employees struggling to make ends meet, understanding tax credits and deductions can make a significant difference in their finances. In this blog post, we’ll explain the importance of understanding the Earned Income Tax Credit (EITC) and other ways to keep more of your hard-earned money.

What is the Earned Income Tax Credit?

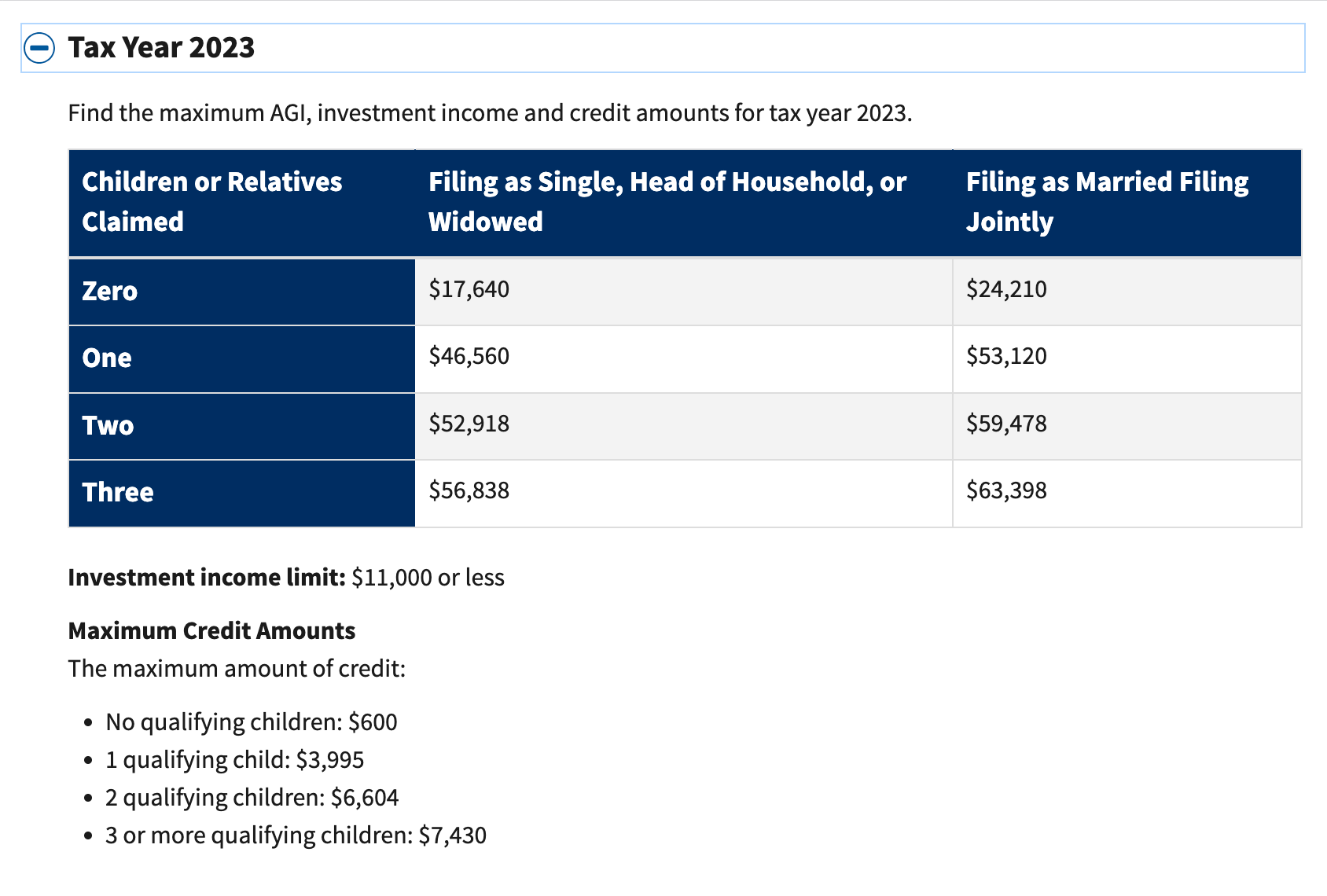

The Earned Income Tax Credit (EITC) is a tax credit that is available to low- to moderate-income individuals and families. The credit is designed to help offset the burden of Social Security taxes and help low-income workers keep more of their earned income. The EITC can be a significant credit, with the maximum credit amount for the 2023 tax year being $7,430 for families with three or more qualifying children. By understanding the EITC, individuals and families can receive a substantial refund and keep more of their hard-earned money.

Tax credits, like the EITC, are different from tax deductions. Tax deductions are expenses that can be subtracted from your taxable income, reducing your overall tax liability. Tax credits, on the other hand, are directly applied to your tax liability, reducing the amount of taxes owed. Understanding the difference between these two types of deductions is essential to making informed decisions about your finances and taxes.

How to Pay Less in Taxes

Another way to pay less in taxes is to take advantage of available tax deductions. For example, a student may be eligible for education tax credits such as the American Opportunity Tax Credit or the Lifetime Learning Credit. Medical expenses, charitable contributions, and educational-related expenses are just a few of the other deductions you may qualify for. Taking advantage of available deductions can help reduce your tax liability, ultimately keeping more money in your pocket.

Most importantly, tax planning and preparation can help you reduce the amount of taxes owed to the government. You can do this by contributing to retirement accounts like a 401k or IRA, taking advantage of your employer’s flexible spending account, investing in home improvements or energy-efficient appliances, and making charitable donations. These options not only help you reduce the taxes you owe but could also give you a sense of fulfillment and accomplishment.

The other way to pay less in taxes is by becoming an owner. Whether you buy property or own a business, ownership has its own tax deductions and credit perks that you absolutely want to benefit from. For example, items I’ve purchased for my home office/ media studio can help lower the amount of money I pay in taxes. Employees who purchase the same items don’t get the same tax benefits and may pay more taxes.

Keep More of Your Money Today

Understanding the Earned Income Tax Credit and other tax credits and deductions can help employees struggling with debt and trying to climb out of the rat race. By taking advantage of these benefits and engaging in tax planning, individuals can reduce the amount they owe in taxes and keep more of their hard-earned money in their pockets. Don’t let taxes become a burden on your finances. Visit my blog and take the time to learn about credits, deductions, and other ways to save money and make informed decisions about your finances.

You can also subscribe to my newsletter to learn how to get free personal finance coaching, including reviewing whether you may qualify for the EITC.