5 Ways Credit Scores Matter

Are you currently in debt and struggling to improve your credit score? You’re not alone. Many people find themselves in this situation, but it’s essential to understand that your credit score matters more than you may think. A credit score is like your financial report card, and even a seemingly small credit score difference can affect your financial future.

Personally, I didn’t always have a good credit score. I didn’t always understand the importance of it since I never spent the time to understand it. The public school system never taught me this. And unfortunately, my mother’s credit score wasn’t the best, so I’ll leave it at that. But times have changed, and today, I’m all about financial literacy and education for everyone. While Black Lives Matter will always be relevant, 2024 should be the year we all agree that credit scores matter. So, in this blog post, we’ll explore why your credit score matters more than you think and how improving it could make all the difference in your life.

Credit scores matter because…

1. Credit scores matter because they affect your ability to get approved for loans.

Your credit score is one of the most significant factors lenders use to assess your risk. A low credit score can mean you’re a high-risk borrower, so lenders may reject your loan application or grant it with unfavorable terms such as high interest rates or higher down payments. If you want to get approved for a home or car loan, it’s essential to have an excellent credit score.

2. Credit scores matter because they affect the interest rates you’ll receive.

When you borrow money, the lender charges interest on the amount you borrow. A higher credit score means lower interest rates, resulting in significant savings over time. With a lower credit score, you’ll likely have to pay much higher interest rates, making it more challenging to pay back your loans.

3. Good and bad credit scores affect your ability to rent an apartment.

Many landlords and property managers check credit scores as part of the rental application process. A low credit score can limit your rental options, making it challenging to find a suitable place to live. Some landlords may even reject your application entirely based on your credit score. You could miss out on a great apartment or rental home because of a low credit score.

4. Your credit score affects your employment opportunities.

More companies are looking at job applicants’ credit scores as part of their hiring process. A low credit score could prevent you from being employed or getting promoted. Employers may view a poor credit score as an indication of financial instability. This could harm your chances of being offered a job that requires handling money or other financial responsibilities.

5. Credit scores matter because they affect your peace of mind.

It’s hard to feel at ease when you’re constantly worried about your financial situation. A low credit score can cause a lot of stress, anxiety, and headaches. A good credit score makes you more comfortable knowing you can get approved for loans and other financial products on favorable terms. Your peace of mind is priceless!

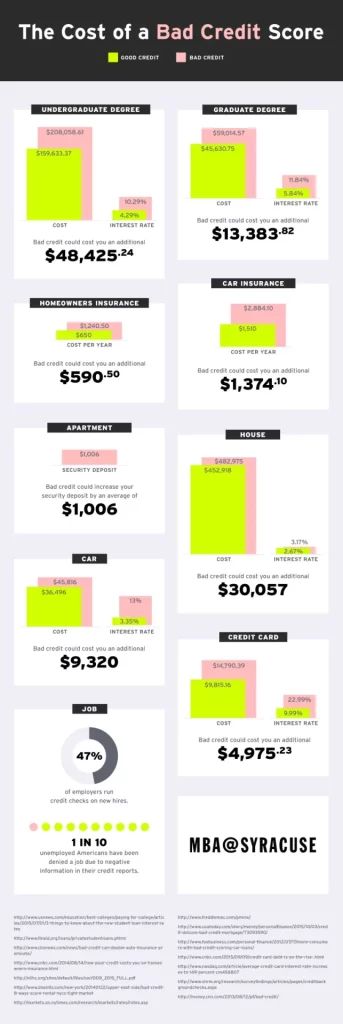

The Cost of Bad Credit Scores

Some of you reading this might think I’m exaggerating, but trust me, your credit scores matter and can help you save thousands of dollars throughout your lifetime. And don’t just take my word for it; check out these credit score statistics from Syracuse University, which show a bad credit score can cost an additional $50,000 per year for an undergraduate degree. Want to buy a house? Cool, but be prepared to spend an additional $30,000 with bad credit compared to your neighbor with good credit. And some employers will even pass you up on that new job simply because of your bad credit score.

Build Credit Today

Now that you know credit scores matter and that your credit score is more than just a number, you should try to improve your score. It’s a vital tool that lenders, landlords, and employers use to check your creditworthiness and assess risk. By improving your credit score, you can access more favorable terms, have more significant financial opportunities, and achieve peace of mind. Don’t let a low credit score hold you back from reaching your financial goals. Visit the blog for some tips to help you start taking steps to boost your credit score and improve your financial health. Subscribe to my newsletter for more personal finance support to help build your credit score.

One Comment